Small businesses have to deal with a lot of anxiety and stress due to limited finances, employee issues, bill payments, wellness programme costs and many other expenses. One such unavoidable loss of these businesses is the payment of taxes. Since the cash flow of small businesses is less as compared to large enterprises, they can’t bear to give their hard-earned income to the government in the form of taxes.

Hence these businesses are always on the lookout of tax-saving hacks, which helps them reduce their outgoing cash flow. They try to save their earnings on all avoidable expenses like, saving on software, stationary, or any other miscellaneous fees, which in turn leads to increased profits, maximizing investments and reduction in stress levels.

Almost all businessmen are aware of some common tax strategies, and they try to implement the same, to reduce the taxable amount on their earnings. But there are a few small business tax-saving techniques, which are missed out or overlooked, which lead to a decline in your profit graph.

In this article, I have summarised a few missed out tax savings hacks for small businesses. Let’s have a look at some of them.

Tax Saving Tips for Small Businesses:

Use Tax Filing Software:

Tax filing software’s proving to be the best, not only for small businesses but also for large companies and corporate enterprises. Many small companies hire professional financial advisors for tax tips. Many times it is possible that unknowingly or due to lack of knowledge, your tax advisor may give wrong advice; which may result in overpayment of taxes.

Tax filing software’s are not only cheap in costs and accurate in filing returns, but they also guarantee maximum refunds. They also promise a reimbursement of penalties or fees, if any, thus increasing incoming cash flow.

Some of the best tax software programmes are TurboTax, TaxAct Premium, H&R Block, Liberty Tax etc.

Organize your receipts:

Receipts are proof of the money spent during the year. These expenditures help you in planning tax deductions. But storing receipts for a whole year can be a tedious task. Credit cards and online banking have made this task (organizing expenditures) simpler. Yearly statements are available, which can give you a clear picture of the same.

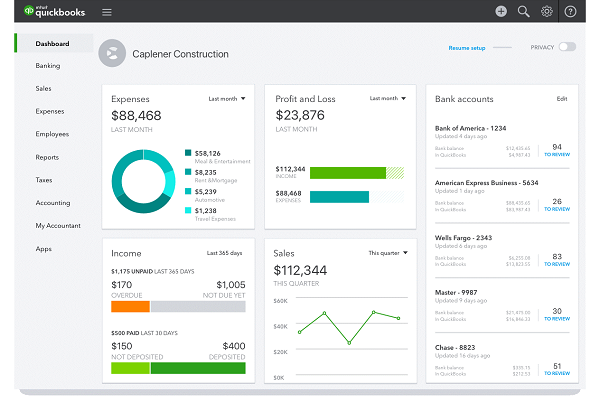

For instance, QuickBooks is one such software tool, whose main motto is to help small and medium businesses in their accounting applications, management of bills and smooth functioning of payrolls. It’s automation in sales tax calculations, and updation of bills and transactions is commendable. It tracks all your tax-deductible expenses, and the best part is that it is connected with tax filing software’s like TurboTax too.

Pay prior to Retirement:

As per law, you can reduce your taxable income by putting some extra money in a retirement account. The money will be taxable only when the withdrawal transaction takes place in the retirement account.

Employees are offered 401(k) plans by many employers as a way of saving for retirement. 401(k)s are important to consider when leaving a job. So What to do with 401k after leaving a job?. When you leave a job, you have four options when it comes to managing 401(k).

A small business owner, ageing less than 50 years, can invest money in a retirement account, like an IRA or traditional 401(k) and shell out $5500 per year. If your age is more than 50 years, you need to pay $ 6,500 per year to get more money post-retirement.

These tax hacks are such that you pay more tax when you are earning, and less tax, when your income is minimised or nil; thus giving you a secured retirement.

Deduct your Home Office:

Working from home is not a new criterion anymore. Lots of small businesses having limited staff love to operate from home, to save some extra money because they do not have to pay for office rent. But these owners are unaware or afraid of the fact that they can deduct home office expenses.

Home office expenses include power, heat, Wi-Fi, water, rent, maintenance, repairs, utilities, depreciation etc.

If you have clean records, you can easily claim home office deduction to lower your tax bills. Tax Filing Software helps you in the calculation and deduction of the taxable amount.

Your Car Expenses:

You can deduct your auto expenses when you are using your car for office work. The Internal Revenue Service (IRS) has two different ways of calculating auto deductions.

From your actual expense (fuel, maintenance, and repair), deduct the business usage of your vehicle.

Check your exact mileage and go for a tax deduction on the same.

See which way works the best for maximising your finances and minimising your taxes. For details on how to calculate tax using both methods, click here.

Use IRS Section 179 as Trump Card:

Keeping in mind, the income of small businesses, Section 179 was introduced, wherein the business owner can ask for a deduction on an asset in the 1st year of its purchase itself. The best part of Section 179 is that the same benefits continue in the coming years too.

All tangible or purchased assets (not leased) put to business use, come under Section 179 deduction. Since this expense deduction can be claimed soon after buying any asset, it encourages small businesses to buy more assets and start using them at the earliest.

Section 179 calculator is also available, which helps you calculate your tax deductions and savings on your purchased asset.

Recruit Family Members:

Family members are much better than unknown employees provided they are well versed with your business and can come handy in specific business tasks.

Recruiting of family members in your small business has a dual advantage. By paying them a fair share for their work, you can not only claim a business deduction for the same, but the money you pay to them stays in your family too.

Keep Track of your Carry-Forwards:

Many times all the tax deductions may not be fully utilised in a year, and hence you can carry forward the same in the coming next years. Keep track of those deductions like charitable contributions, interest on investment, capital losses, operational losses etc.

Loss Carry-forwards: As per IRS, all business losses can be carried forward to 20 years to avail tax benefits; post which they are not valid for reducing taxes.

Recruit Contractors and Freelancers:

Independent contractors and freelancers are preferred over permanent employees in small businesses. Though both have their advantages, viewing from the taxation point of view and other expenses, your small business should hire freelancers for any project work.

One main reason is that as per government regulations, permanent employees need to be provided minimum wages, overtime pay, health insurances, medical expenses and other taxes too. This proves to be expensive to small businesses who are working with tight margins.

On the other hand, if the work is allocated to freelancers. These expenses are saved since they are paid on a project basis or an hourly basis.

Wrapping Up:

Small tax tips help a lot in business savings. In small businesses, each penny counts, and hence it’s essential to utilise these tax tips for gaining maximum earnings.

Good financial management of taxes, with tax filing software, will not only minimise expenses and taxes but will also improve the financial status of your small business.

Educate and investigate these options and alternatives wherein you can save on paying tax so that you gain more and pay less.